|

Growing tensions in Iraq have already begun to impact oil prices. Crude oil prices have already hit 10-month highs and gas prices, which typically rise during summer months anyway, may go even higher. Oil is now up to $107 a barrel.

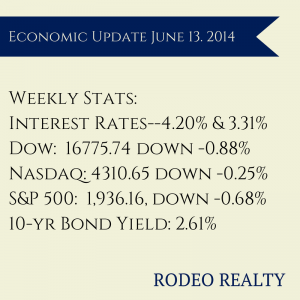

The retail sales report for May from the Commerce Department showed that retail sales rose 0.3%. This was below economists’ forecasts of 0.5%.April’s sales gains were revised up to 0.5% from a previously reported 0.1%. Excluding motor vehicles and parts, retail sales rose only 0.1% in May compared with a 0.4% increase in April from March. The Thomson Reuters/University of Michigan’s preliminary June reading on the overall index on consumer sentiment dropped slightly to 81.2, down from 81.9 the month before but overall consumers remain cautiously optimistic about the economy. Stocks rose a bit on Friday repairing some of the damage from earlier in the week. This was the worst week in two months for the U.S. stock market. The Dow closed at 16775.74 down -0.88% from last week’s close of 16,924.28. The Nasdaq was also down, closing at 4310.65 down -0.25% from last week’s close of 4,321.40. The S&P 500 closed at 1,936.16, down -0.68% from last week’s 1,949.44. The 10 year Treasury bond yield ended the week at 2.61%. It was 2.60% last Friday and 2.19% a year ago. The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate was is back on the rise, up to 4.20% from 4.13% last week. The 15-year-fixed was also up to 3.31% from last week’s 3.23%. A year ago the 30-year fixed was at 3.98% and the 15-year was at 3.10%. Jumbo rates are only slightly higher. There is almost no difference in rate between conforming and jumbo mortgages right now. RealtyTrac® reported that foreclosure filings continued to drop in May. They were down -5% from the previous month and down -26% year over year to the lowest level since December 2006. Bank repossessions are at the lowest level since July 2007 but they are up in some states including California which had a year-over-year increase of 26%. Nationwide foreclosure auctions are also at their lowest level since December 2006. Foreclosure starts around the country have hit their lowest level since December 2005. DataQuick’s latest numbers show that in May, 19,556 new and previously owned houses and condos sold in the six county Southland region, down -2% from April and down -15% from a year earlier. This number was -23% below the May average of 25,393 sales. Sales in L.A. County fell -16% from a year ago to 6,460 properties. This was the eighth month in a row that sales have fallen year over year according to DataQuick. Last month, the region’s median price rose 11% to $410,000 from $368,000 in May 2013. In Los Angeles County alone, the median price rose 10% to $450,000 from $410,000 a year earlier.

0 Comments

Leave a Reply. |

AuthorGenna Walsh Archives

February 2020

Categories

All

|

RSS Feed

RSS Feed