|

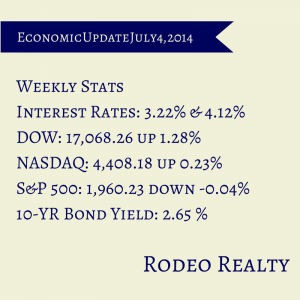

The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate fell slightly again, coming in at 4.12% down from 4.14% last week. The 15-year-fixed stayed even at 3.22%. A year ago the 30-year fixed was at 4.29% and the 15-year was at 3.39%. 30-year mortgages rates dropped from 4.14% to 4.12% and 15-year rates are at 3.22%. Rates ended the week higher after the Labor Department released the June jobs report. The 30 year fixed rate is about 4.375% and the 15 year fixed is about 3.375%.

The Labor Department announced that the country added 288,000 new jobs in June. The most optimistic expectations were 215,000! This was a huge number. The nation’s unemployment rate dropped from 6.3% to 6.1% which is the lowest it has been since 2008. Job creation has been over 200,000 jobs for five straight months. The average job creation for the year has been 231,000 jobs each month. This is the highest six month average since 2006. This jobs report caused the stock markets to surge as it appears that the economy may be growing more robust than previously thought. Unfortunately, good news for stocks is bad news for interest rates! A better economy leads to higher inflation, and allows the fed to raise short term rates. It also allows the stock markets to rise which causes money movement from bonds to stocks, all of which cause mortgage rates to rise. The 10-year Treasury note yield rate ended the week at 2.65% up from last week’s close at 2.54%. It was 2.52% a year ago. The Dow closed at 17,068.26 a record high! It was up 1.28% from last week’s close of 16,851.84. The Nasdaq had another strong week, closing at 4408.18 up 0.23% from last week’s close of 4,397.93. The S&P 500 closed at 1960.23, down -0.04% from last week’s 1,960.96. Pending home resales jumped 6.1% in May, according to NAR! This is largest jump since April 2010 which was spurned by the first time buyer tax credit. The May sales were 5.2% below last May’s sales, but it is still a good sign as economists had predicted sales to be up only 1.5% for the month. One factor in the drop in sales year over year is fewer foreclosures, another is low inventory. It is an unusual time in the market. On one hand we are seeing price increases begin to stall. In many areas we are seeing homes not selling at or below the price of a previous comparable sale. Certainly this is a sign of prices beginning to flatten. On the other hand we are seeing sales activity increase slightly. There are really no statistics, but I would guess we were writing seven offers for every one accepted due to multiple offers at the beginning of the year and it is more like three written for one accepted now. That is a welcome relief! We are seeing the investors pull back a little as well, so competing with cash offers is not as common as a couple of months ago. It is much easier to be a buyer than it has been the last year or so. Especially one that needs to get a loan, as there are fewer multiple offer situations. For the sellers it is still a great time, but more attention must be paid to pricing. Most sellers are also buyers after they sell. One issue they were facing was trouble finding a home after they had sold their home. They are finding themselves much better off now that the market is stabilizing!

1 Comment

|

AuthorGenna Walsh Archives

February 2020

Categories

All

|

RSS Feed

RSS Feed